Mind the Gap—Diversifying Across Countries

July 17, 2025

Karen Umland, CFA | Senior Investment Director and Vice President, Dimensional Fund Advisors

In the first half of 2025, developed markets outside the US returned 19.0%,

outperforming the US and emerging markets.1 But that outcome masks the wide range of returns across individual countries, from Spain’s 43.0% to Denmark at −5.5%. This kind of dispersion isn’t unusual—it’s a defining characteristic of global investing.

The Difference the Right Financial Advisor Makes

March 13, 2025 | Dimensional Fund Advisors

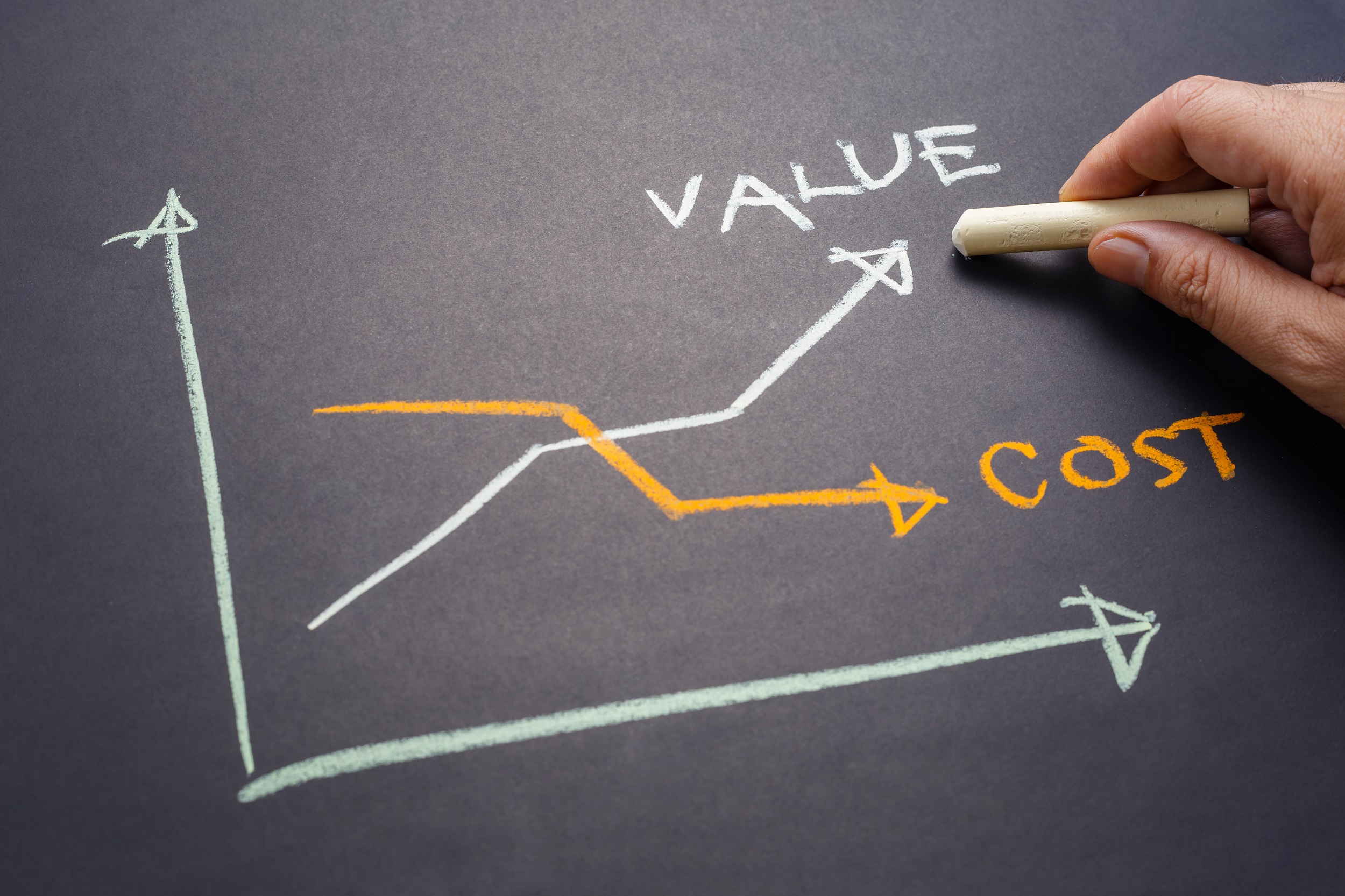

A financial advisor can provide the perspective investors need to tune out the daily noise and stay focused on a long-term plan.

Tariffs and Stagflation

March 3, 2025

Wes Crill, PhD | Senior Investment Director and Vice President, Dimensional Fund Advisors

One of the concerns arising from tariff talks is the possibility of stagflation, or the combination of rising inflation and an economic contraction. But should investors act on these concerns with their investments?

Election Results Shouldn’t Dictate Your Investments

December 23, 2024

Wes Crill, PhD | Senior Investment Director and Vice President, Dimensional Fund Advisors

The US presidential election has concluded, but uncertainty remains about what comes next. For those focused on market returns, it can be helpful to look at the historical success of markets across presidencies.

Presidential Elections: What Do They Mean for Markets?

November 11, 2024 | Dimensional Fund Advisors

One thing we can count on around Election Day in the US is that plenty of opinions and predictions will be floated in the days surrounding the vote. In financial circles, this will inevitably include discussion of the potential impact on markets. But should elections influence long-term investment decisions?

Midyear Review: Stocks Maintain Momentum at Year’s Halfway Point

August 5, 2024 | Dimensional Fund Advisors

The beginning of 2024 started out a lot like the end of 2023, with markets rising amid talk of a potential decrease in US inflation and interest rate cuts from the Federal Reserve that could follow. But much like last year, those expectations remained unfulfilled, as core inflation fell slightly but held above 3% and the Fed stood pat on interest rates.

10 Minute Tuesday: The Fed, Inflation, Interest Rates and Potential Recession

May 21, 2024 | Presented by Apollo Lupescu, PhD, Vice President, Dimensional Fund Advisors

In this webinar, Apollo will overview the Federal Reserve’s aggressive interest rate hikes amidst rising inflation and explore the potential historical parallels shaping current economic decisions. In just 10 minutes, you’ll gain insights into the future direction of interest rates and the implications for inflation trends and stock market stability.

Protecting Your Portfolio in a Presidential Election Year

May 13, 2024 | Written by Jared Kizer, CFA | Head of Investment Research at Buckingham Strategic Partners

The 2024 presidential election is set to be a repeat of the Biden versus Trump contest of 2020. With both houses of Congress up for grabs, the stakes are high for either party, so it is understandable for the U.S. public to be nervous. Regardless of how the election plays out, political tensions will likely remain elevated throughout the next president’s term, adding to an already contentious global political climate. Against this backdrop, many investors are anxious about the possible impact on financial markets. Here’s what to keep in mind this election season.

Uncertainty is Underated

February 15, 2024 | Dimensional Fund Advisors

For many people, uncertainty is something to avoid or at least mitigate. But what about the positive things that uncertainty can bring? Without it, there would be no surprises, no joy in watching sports, and no 10% average annualized return on the stock market over the past century.

Investing Is a Science, an Art, and a Practice

October 16, 2023 | Dimensional Fund Advisors

When you have both science and a trusted professional on your side, you never feel alone when weathering life’s inevitable storms. You’re well-equipped to stick to a long- term strategy that can best position you to achieve your goals. And even when things don’t go exactly the way you planned, you know you’re still probably going to be OK. That’s peace of mind money can’t buy.

You Know More About Investing Than You Think You Do

September 29, 2023 | Dimensional Fund Advisors

Investing better means living better. Not just because it can lead to having more money, but because many of the habits that serve us well as investors serve us well in life, too. By integrating our life and investment philosophies, we can see money as a tool that empowers our plans rather than as a goal in and of itself. Here are six principles that can help you in life and in investing.

Stock Gains Can Add Up After Big Declines

September 4, 2023 | Dimensional Fund Advisors

Sudden market downturns can be unsettling. But historically, US equity returns following sharp declines have, on average, been positive. A broad market index tracking data since 1926 in the US shows that stocks have tended to deliver positive returns over one-year, three-year, and five-year periods following steep declines.

Practicing Healthy Habits, Pursuing Wealthy Outcomes

August 21, 2023 | Dimensional Fund Advisors

Investing and health can be two of the most important things in life, but sometimes they also can be the most confusing. There’s so much data and advice, so many articles—and unfortunately, they often don’t agree.

Midyear Review: Staying Focused as Markets Shift

August 7, 2023 | Dimensional Fund Advisors

The first half of the year has given investors plenty to process—from banking turmoil to a morphing yield curve to the debt ceiling debate. Those with diversified portfolios of equities and fixed income were in a good position to benefit from both assets’ advances at the year’s midway point, a welcome turn from last year’s broad declines.

Mind over Matter: Perspective for Investors on the US Debt Ceiling

July 10, 2023 | Dimensional Fund Advisors

If ongoing debate over the debt ceiling is giving you a dizzying sense of déjà vu, you are forgiven. The debt ceiling, or limit, reflects the amount of money the United States (US) Congress has authorized the government to borrow, and Congress can authorize increases when the government nears or reaches the existing limit. According to the US Treasury Department, Congress has acted to effectively raise the debt ceiling 78 distinct times since 1960.1 Occasionally, policymakers have struggled to reach consensus to authorize increases.

David Booth in the Financial Times: Why the Wisdom of the Market Crowd Beats AI

June 26, 2023 | By David Booth, Chairman and Founder of Dimensional Fund Advisors

Can artificial intelligence help pick stocks? More specifically, can investors use AI to

determine the fair price of a stock or a bond? I bet a lot of people right now would say yes, given recent advances that allow for the processing of ever greater amounts of information. I think my AI is better than all the other ones out there. My AI is the market.

The Stock Market vs. Stocks in the Market

May 26, 2023 | By David Booth, Chairman and Founder of Dimensional Fund Advisors

The collapse of First Republic Bank is a harsh reminder that any stock can go to zero, no matter how established a company is, or how loyal and wealthy its customers are. The failure of what many considered to be a rock-solid regional bank should serve as powerful evidence of the importance of diversification, what I consider to be one of the first principles of investing.

Two Steps Forward, One Step Back for Investors

May 12, 2023 | By David Booth, Chairman and Founder of Dimensional Fund Advisors

One of the most important principles of investing is being a long-term investor with an investment plan you can stick with. The stock market will go up and down. It always has; it always will. If during this three-year period you felt like you had to bail out of stocks for some reason, then you had probably invested too much in stocks to begin with. But if you had about the right amount, for you, invested in stocks, there was a good chance that you didn’t have to make any adjustments to your portfolio mix. What will happen over the next three years?

When Headlines Worry You, Bank on Investment Principles

April 17, 2023 | Dimensional Fund Advisors

Rather than rummaging through your portfolio looking for trouble when headlines make you anxious, turn instead to your investment plan. Hopefully, your plan is designed with your long-term goals in mind and is based on principles that you can stick with, given your personal risk tolerances. While every investor’s plan is a bit different, ignoring headlines and focusing on the following time-tested principles may help you avoid making shortsighted missteps.

People have memories. Markets don’t.

February 20, 2023 | By David Booth, Chairman and Founder of Dimensional Fund Advisors

One of the best things about markets is that they don’t have memories. They don’t remember what happened last week or last year. They don’t even remember what happened a minute ago. Prices change based on what’s happening right now and what people think will happen in the future. People have memories. Markets don’t. And that’s a good thing.

SECURE 2.0 and Volatile Investment Markets

February 14, 2023 | 10 Minute Tuesday

A number of interesting changes for investors arrived during the last three months of 2022, both in market returns and through legislation. The SECURE 2.0 Act was passed to help strengthen Americans’ retirement readiness by reducing barriers to annuitization, increasing access to workplace retirement plans, and improving opportunities to save for retirement. Join Chris Bedient, CFA, CFP®, during this 10 Minute Tuesday to understand how to navigate retirement planning through volatile investment markets. In addition, Chris will overview the current market.

November 28, 2022 | By Dave Butler, Co-Chief Executive Officer of Dimensional Fund Advisors LP

Cybercrime & Identity Theft Resources

As your trusted advisors, helping you achieve your life goals is part of our mission. This includes educating you on how to protect yourself from things that threaten those goals. In today’s digital world, one of the most crippling threats comes in the form of cybercrime and identity theft.