Written by Wes Crill, PhD | hD Senior Investment Director and Vice President

The US presidential election has concluded, but uncertainty remains about what comes next. For those focused on market returns, it can be helpful to look at the historical success of markets across presidencies.

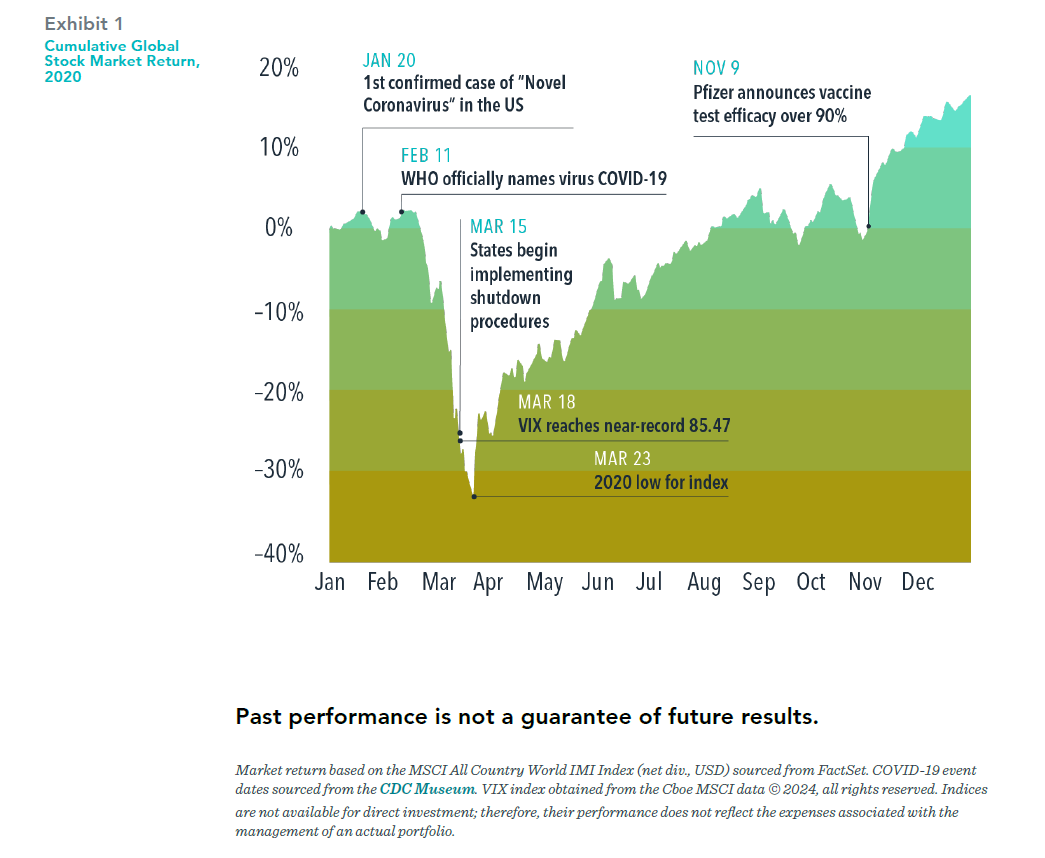

It’s important for investors to remember that whether you are optimistic or pessimistic about the future state of the world, you should be optimistic about the market. This is easy to demonstrate using a time when optimism was in short supply. By the end of March 2020, the state of the COVID-19 pandemic painted a scary picture of what the future held for the economy and life in general. And yet, divesting from stocks at that point would have been an expensive mistake. From the market’s bottom on March 23 through the end of the year, the MSCI All Country World IMI Index returned nearly 74%, finishing the year higher in level than before the start of the pandemic.

Why did this happen? Market prices continually reset to offer positive expected returns given expectations each day. And consumers continued to consume. We weren’t going to malls or theaters. But there was still demand for goods and services, and business owners continued to operate with the goal of profitability. If the world kept spinning on its axis during this period—and markets grew investors’ account balances—it’s worth asking what will be different this time.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affliates.

Recent Comments